[ad_1]

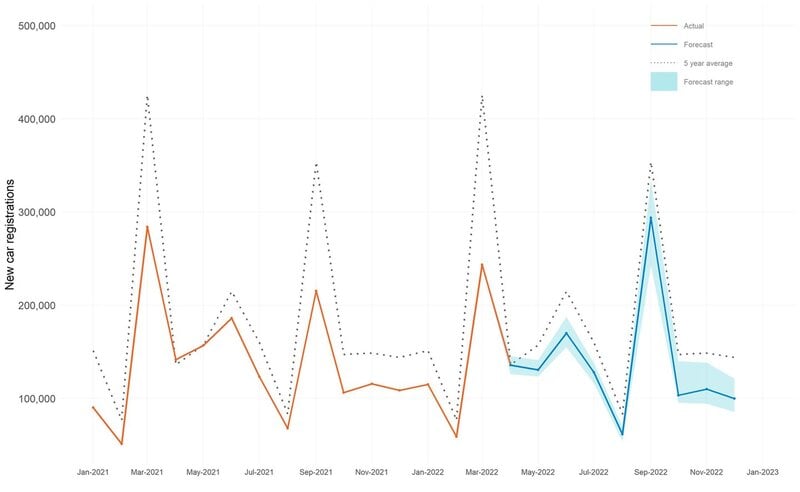

New motor vehicle registrations are expected to decline 10% yr-on-calendar year in the first half of 2022 with all hopes pinned on a recovery in H2, Cox Automotive’s most recent forecasts expose.

The automotive remarketing and expert services service provider has after once again revised down its projections for the UK’s new vehicle market place in figures revealed in the most current edition of its Autofocus publication, with insight and approach director Philip Nothard conceding: “It is seeking increasingly possible that the pre-pandemic automotive marketplace we all understood may well never ever return.”

Nothard thinks that downgrades would have been on the playing cards even with no the influence of Russia’s invasion of Ukraine, with world-wide car or truck output anticipated to be down by 31 million this year.

Nothard thinks that downgrades would have been on the playing cards even with no the influence of Russia’s invasion of Ukraine, with world-wide car or truck output anticipated to be down by 31 million this year.

As a result, its revised baseline registrations situation now sees Q2 2022 conclude on 436,286 registrations, a reduction of 9.9% calendar year-on-yr, when Q3 2022 is now predicted to stop on 483,433 registrations – a 22% raise.

Cox Automotive expects the baseline situation for the total yr to stop on 1.65 million registrations, a .2% increase yr-on-12 months, but a 13.8% downgrade on prior forecasts.

Its upside circumstance of 1.83 million signifies a 11.2% 12 months-on-12 months boost, meanwhile, resulting in a 14.1% downgrade.

Nothard mentioned: “Whether it is a growing quantity of companies switching to the company design or ongoing source chain disruption, the UK’s automotive sector looks set for brief to medium-expression volatility and may possibly perfectly emerge from this looking entirely diverse to pre-pandemic amounts.”

Nothard mentioned: “Whether it is a growing quantity of companies switching to the company design or ongoing source chain disruption, the UK’s automotive sector looks set for brief to medium-expression volatility and may possibly perfectly emerge from this looking entirely diverse to pre-pandemic amounts.”

Earlier this thirty day period Society of Motor Makers and Traders (SMMT) registrations data showed that the Uk automotive sector has suffered its worst March new car registrations consequence given that 1998.

SMMT chief government Mike Hawes stated that the result, which remaining Q1 registrations down 1.9% 12 months-on-12 months even with a rollback of the COVID-19 pandemic restrictions, “lays bare the troubles ahead”.

As formerly documented by AM, Cox acknowledged that hopes of an early 2022 restoration from the automotive offer chain issues have been dashed by the conflict in Ukraine.

Inspite of soaring British isles inflation, however, car merchants stay self-assured of earning a earnings as buy guides carry on to bulge and shoppers accept the unlikely application of discount rates amid provide shortages.

A lot of clients are even prepared to sacrifice critical trim things to get into a new auto as automobiles roll off generation lines lacking tech-heavy merchandise this kind of as touchscreens, heated seats, and sat navs.

Nothard stated: “Supply headaches also persist from the lengthy-awaited fulfilment of orders built 12 or even 18 months back. Nevertheless, there are also reviews of this year’s buy guides by now being complete, so it is apparent the backlog of orders will only grow, and new orders won’t transform into true registrations right until at minimum H2 2022 or even into 2023.”

[ad_2]

Supply hyperlink