[ad_1]

Forward of the Society of Motor Producers and Traders (SMMT) publication of Q1 new motor vehicle registrations figures, AM takes a appear at February’s tendencies and how Russia “threw a hammer and sickle into the works” of automotive’s 2022 restoration.

In a month where by the earth appears to be to have gone mad, maybe it is only to be anticipated that the automobile marketplace seems to be functioning at an entirely random stage.

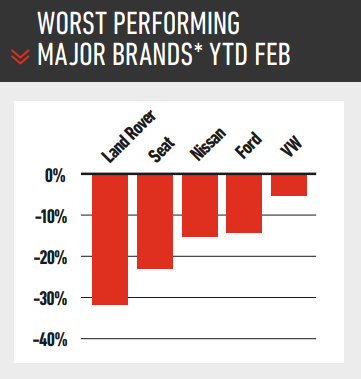

Not only is Kia now the UK’s most effective-offering marque and MG is now outselling the likes of Land Rover, but the sample of company sales increases and falls is unparalleled.

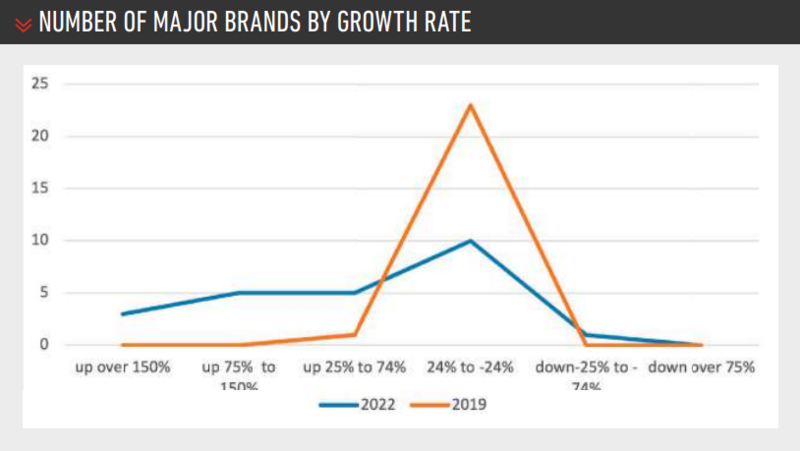

Historically, the auto industry (and rather effectively all other people) follows what is identified as a “normal distribution” – most manufacturers’ sales raises/decreases are shut to the industry average, and the further absent from the common you get, the more compact the number of producers.

Of course, what counts as “normal” has been ever more difficult to define since Brexit, but if we consider yr-to-day (YTD) 2019 as the final pre-COVID year, we can see that the car market adopted the expected sample (see graph).

Of course, what counts as “normal” has been ever more difficult to define since Brexit, but if we consider yr-to-day (YTD) 2019 as the final pre-COVID year, we can see that the car market adopted the expected sample (see graph).

On the other hand, YTD 2022 exhibits no sample at all. Of the 24 significant marques (manufacturers with more than 1.% industry share), 8 have developed by extra than 75%, in comparison with none at all in 2019.

In a industry that was only up by 23.%, that is remarkable. 2022 also saw a much larger quantity of companies with huge falls in contrast with 2019.

The motive may possibly be partly linked to lumpy offer, as companies consider to catch up with demand with cars heading straight from ports to sellers.

Now Russia has thrown a hammer and sickle into the operates, building the predicament even worse.

MG reported on March 1 that it was “temporarily” telling its sellers to end having orders for petrol cars and trucks.

At minimum that transfer appears to be in line with all round marketplace developments: Automobile Trader is reporting a spike in electric automobile (EV) queries as a reaction to mounting oil costs.

Certainly, there is no signal of the traditional response to rising gasoline rates – i.e. get a extra economical diesel. Diesel sales have fallen by 34.6%, with market place share slumping from 18.9% YTD 2021 to 10.1% YTD 2022.

High quality brand names nevertheless promote a reasonably big variety of diesels – about 20% of overall gross sales for BMW and Audi, but most brands are much lower. The only outlier is Land Rover, 41% of which are however diesel.

One particular would assume a model that concentrates on significant SUVs to have a comparatively significant diesel proportion, but it leaves one thing of a chasm in between where by Land Rover is now and where it demands to be by 2030.

Quite a selection of brands have a diesel proportion of either zero (Nissan, Mini, MG, Honda, Fiat) or close to zero (Toyota, Hyundai).

Quite a selection of brands have a diesel proportion of either zero (Nissan, Mini, MG, Honda, Fiat) or close to zero (Toyota, Hyundai).

In phrases of the over-all market place, it is as considerably a problem of supply as need. The war in Ukraine is impacting crucial raw components (e.g. nickel for batteries, palladium for catalysts and neon for microchip manufacturing), but Ukraine experienced also come to be a sizeable assembly spot for Tier 1 suppliers.

It created a large selection of wiring harnesses, and also had some factories creating key digital parts.

A single provider explained to us it had two weeks’ source in the method at the begin of the war. If it was to try to start output in a western European manufacturing unit, it would will need 8 weeks for “soft tooling” (equipment that can past a calendar year or two just before carrying out) or 16 weeks for “hard tooling” that will past the life time of the product or service.

Of class, the worth of the applications currently in Ukraine would have to be prepared off. The only option would be to try out to supply from parallel factories in China, but present factories are not able to instantly double output.

Returning from geopolitics to the below-and-now of the Uk car current market, the fastest expansion has been found in superminis, which have produced at double the level of the over-all sector (46.5%).

This might not reflect any alter in need, but somewhat a reflection that a good deal of suppliers switched output in 2021 to far more financially rewarding larger sized automobiles, cutting down supermini product sales.

Till Putin ruined their designs, vehicle suppliers experienced been anticipating the chip shortage to relieve this year, so output of smaller cars and trucks had been on the rise.

At a producer degree, the large information is of course the current market leadership place of Kia.

At a producer degree, the large information is of course the current market leadership place of Kia.

Kia is not likely to hold that location for very long, but it would be a error to dismiss its 8.2% marketplace share as just a statistical quirk.

Kia may well be executing very well partly due to the fact it has better availability, but every single new buyer it sells to now is a single far more buyer introduced into the Kia fold.

If it can continue to keep them in the fold in 3 years’ time, then it has a fantastic system to make on.

In second put is BMW – a further unparalleled outcome. Of the other major 10 producers, the most important development has occur from Hyundai (100.6%), while that is much more a circumstance of restoration after some lousy decades, than underlying growth. Notable is the title not in the best 10 – Nissan, whose Sunderland factory is the jewel in the crown of British manufacturing, is in 12th place (down 15.4%).

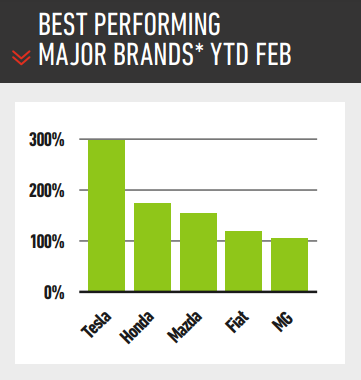

Outside the house the conventional makes, Tesla continues to make massive progress.

Outside the house the conventional makes, Tesla continues to make massive progress.

Tesla does not officially report its income, hiding coyly in the “Others” category of the SMMT (appreciating that the word “coy” is not normally attached to Elon Musk). Nonetheless, it is not challenging to deduce its market place share, which is 1.5% YTD, with the Product Y and the Model 3 each in the prime 10 for the month of February.

As for upcoming month, the more substantial volumes of the March registration plate transform may flatten out some of new fluctuations. On the other hand, offer challenges could suggest a really weak March. As a film producer after mentioned about Hollywood: “No one is aware anything”.

Creator: David Francis

[ad_2]

Source url