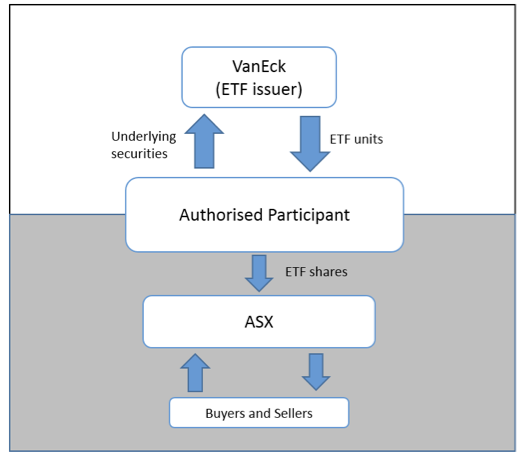

ETFs have a Creation or Renovation process, which is the lifeblood of these securities and is the primary difference between them and equities since ETFs do not begin trading on a stock exchange via an Initial Public Offering.

The following is the continuous process by which ETFs operate:

The only investors who can create or redeem new Trade ETFs shares are large institutional investors known as Approved Participants (APS), large market makers. They transact with the ETF manager to build new ETF shares.

On the other hand, the ETF executive converts which shares it wants to buy in the fund (for example, an ETF monitoring the SP/TSX would want to own all of the securities in the index at the same weight). The formation basket is what it’s called.

The APS goes to the market, buys the stocks in the creation basket in the appropriate amounts, uses the shares they already have, and offers this representative basket of securities to the ETF in exchange for an equivalent sum (value). ETF shares the mechanism may also operate in reverse, allowing an AP with an ETF block to transact with the ETF manager and obtain an equivalent basket of underlying securities. If the ETF manager is trying to get rid of a particular collection of shares, this second basket is known as the redemption basket and is normally the same as the formation basket.

This is done in big blocks called creation units, which are mostly equivalent to 50,000 ETF shares. One basket of underlying stocks is exchanged for one basket of ETF shares in a one-to-one ratio.

The arbitrage difference varies reliant on the fluidity of the securities and implied costs. Still, it usually causes the ETF’s price to be near its fair market value since the creation basket is announced at the start of the day and is open to all market participants.

Who are the ETF’s Approved Participants?

An Exchange-Traded Fund has Authozied Participants who help facilitate the demand for fund units, a unique feature. Regulatory directives designate authorized Participants (APS) to establish and redeem ETFs. Large financial institutions with significant purchasing power and market makers, such as large broker-dealers and investment banks and businesses, are referred to as APs. APS compile the requisite portfolio of asset components and hand it over to the fund in exchange for many newly formed ETF shares when forming the fund. When redemption is needed, APs return the ETF shares to the fund and receive the portfolio basket in exchange. Individual investors can engage in the secondary market by using a retail broker. For more information, you can check at https://www.webull.com/activity.