[ad_1]

The introduction of the Ford Bronco in June 2021 marked the

initially time in decades that a design has been positioned to contend

specifically with the iconic Wrangler. S&P Worldwide Mobility new

car registration data point out Bronco has without a doubt conquested

Wrangler homeowners (far more than any other design), but the Bronco lags

at the rear of the Jeep on a number of metrics, together with share of section.

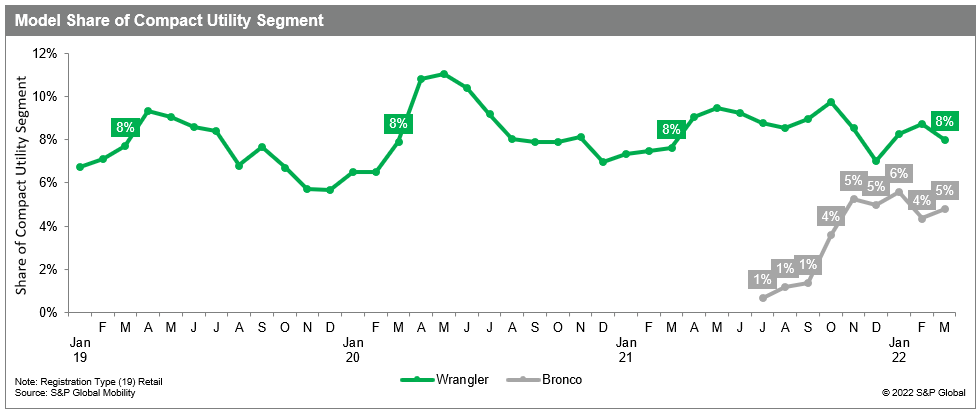

Market share information present that Bronco share of the Compact Utility

Phase has climbed intermittently to 6%, but Wrangler carries on to

account for 7-9% of the segment, suggesting Bronco has not

materially hurt Wrangler. Relatively, S&P World-wide Mobility loyalty

facts counsel the CR-V, Cherokee and Rogue all have ceded share

due to the fact the Bronco start.

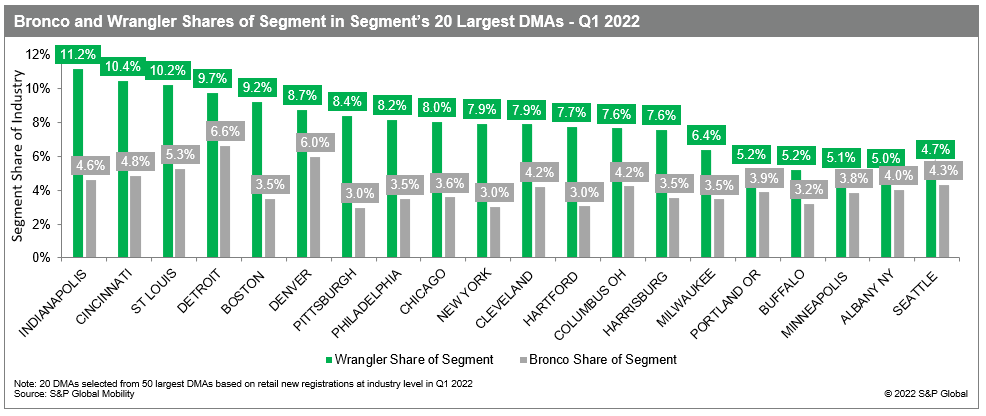

At the DMA amount, Wrangler proceeds to out-carry out Bronco in

each and every 1 of the Compact Utility Segment’s twenty largest DMAs,

however the hole is compact in Minneapolis, Albany (NY) and

Seattle.

Whilst the two models’ customer profiles are related, there are

slight dissimilarities. Bronco buyers skew a bit youthful, have

marginally larger incomes, and are additional most likely to be male when

compared to Wrangler purchasers. The Bronco shopper also is a lot more

probable to be of Western European descent, and a lot less most likely to be

African American, Asian, or Hispanic, when matched with the

Wrangler owner.

The Bronco consumer also is pretty much twice as very likely to have a pickup in

the garage, but a lot less probably to have an SUV or CUV.

Almost 50 percent of Bronco purchasers have a Ford in the garage,

even though slightly considerably less than four of every single ten Wrangler consumers own a

Jeep. The Bronco end result may perhaps be because of in component to its latest

introduction all-new incremental products tend to originally attractiveness

to brand loyalists who are knowledgeable of the new design, have anxiously

been anticipating its arrival, and are among the initially to visit

showrooms to see it.

With regards to the Bronco acquisition itself, S&P Worldwide Mobility

details take a look at this from quite a few perspectives.

Incentives are way down, and approaching zero, given the

exceptionally minimal stock stages, however dealer a lot have a number of

more vehicles than they did back again in the drop.

Wrangler shoppers are eight moments additional probable to lease than Bronco

consumers, most possible driven by very aggressive Wrangler lease

payments. In point, these reduce lease payments are appealing to

rather large credit rating clients, extra very well off than Bronco

lessees. In distinction, Bronco buyers commonly have higher credit rating

scores than Wrangler purchasers.

These increased-credit Bronco purchasers in switch are equipped to borrow

money at decrease fascination fees than their Wrangler counterparts.

Bank loan every month payments for both of those styles, however, skew higher than phase

typical, owing in section to larger transaction price ranges when when compared to

other compact utilities.

Finally, Wrangler consumers ordinarily have a higher bank loan-to-benefit

(LTV) ratio than Bronco customers (and the phase over-all), resulting

from Wrangler buyers’ decrease credit rating-worthiness.

Manufacturer loyalty of return-to-current market Bronco households is substantial

(persistently more than 60%), but, all over again, this is driven in part by the

fact that it was recently introduced this metric ought to decrease

around time. In contrast, Wrangler manufacturer loyalty is in the 44-47%

assortment and under phase typical.

With the Bronco start past summer time, Wrangler’s

conquest/defection ratio (with the business) started to decrease this

metric averaged 1.35 from January 2020 via May well 2021 but dropped

to 1.11 from June 2021 as a result of March 2022. In each individual of the 9

months that the Bronco has been accessible (not which includes June, when

activity was nominal), far more Wrangler households have defected to

the Bronco than have homes with any other car or truck in the

garage. And the variety of Wrangler households that defect to the

Bronco (as a p.c of whole Wrangler defections) has risen to

history highs of 9% and 10% in January and February 2022,

respectively, and 9% all over again in March 2022.

Though these two types have comparable specifications and client

profiles, there is one essential difference amongst them the Wrangler

has been on U.S. roadways, in a person variation or another, considering the fact that WWII,

when the Bronco is only in its ninth thirty day period on the current market (for

which S&P Global Mobility has knowledge). The efficiency of new

products on numerous metrics is distinctive from their general performance soon after

they have turn out to be set up, so we can hope to see alterations in

Bronco metrics relocating ahead.

To obtain the comprehensive report, click

in this article

This post was released by S&P Global Mobility and not by S&P World-wide Scores, which is a separately managed division of S&P World wide.

[ad_2]

Resource backlink